An Open letter to VPAY CEO: Stop giving Fraudsters a Field Day

Dear Sir,

I came across this video by @NaijaBrandChick ( https://www.instagram.com/tv/CRVm8ukp0Wr/) and I was really impressed by the “innovation” and “convenience” that the VFD microfinance bank is bringing to merchants. This “wonderful innovation” through your guidance has received so many praises and accolades because your bank is changing the game for merchants.

You guys have done a tremendous job and going through the product itself and the idea behind it, it is a wonderful one for the financial space but then, I wonder if there is no one in your team that sees what I see. I decided to write you this letter to warn you before your bank goes bankrupt. PLEASE stop the account opening process now if you like yourself, your staff and company.

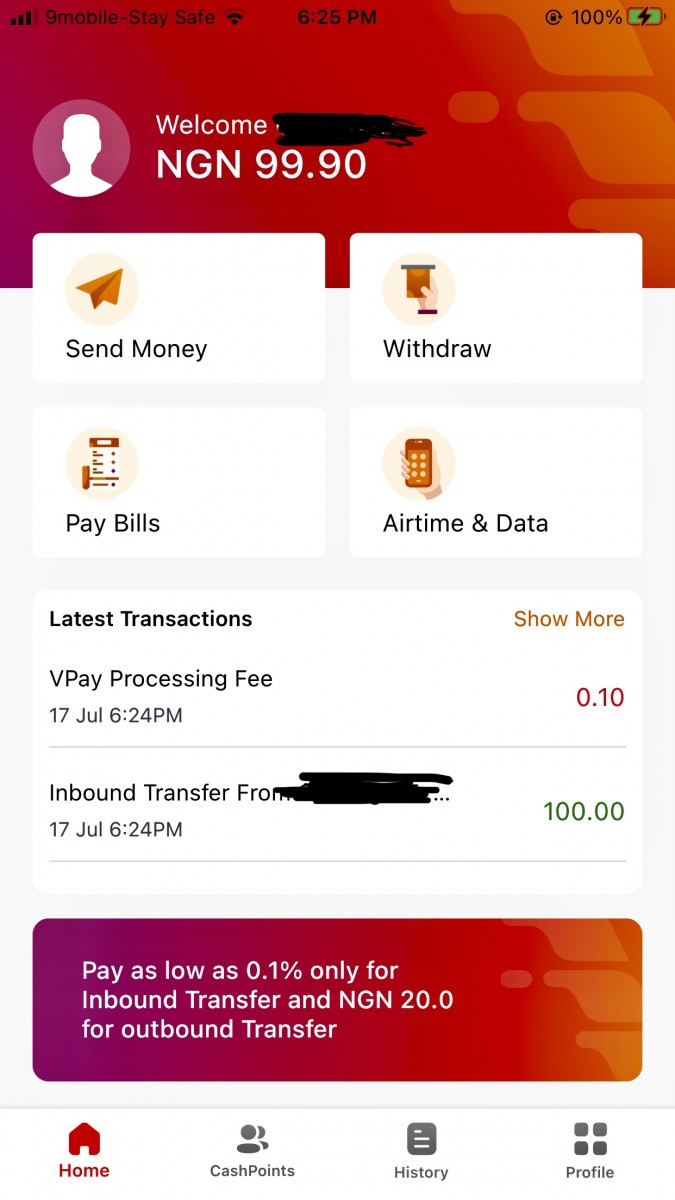

I did a little social experiment and I discovered that your company will get itself into serious trouble when the bad guys get involved in your process (that is if they have not started yet). Below is my experiment for your review:

1. I created an account through your app using fake name, a friend’s phone number and a newly created email address.

2. I created a profile for a known name, and I added foundation as a suffice to the compound name; for example, “OBAMA Foundation”.

3. I went to the account area and picked the bank account.

4. I shared the account number with a friend to send me some money and she did it in less than 1 minute.

5. I moved the money instantly into a lone account.

We all know it doesn’t take fraudsters anything to open a social media account, buy followers and start a grand campaign to dispose the public of their funds. Imagine if a fraudster opens an account with your bank to promote his/her illegal business and the fraudster is cashing out through your platform. I am sure that you know that tracing such funds is tedious and traumatic. It is even so worrisome that there is no sort of check or KYC from your platform.

The experiment I have done does not require any sort of smartness or hacking skills, it is just you and your people (software developers inclusive) not following the laid down CBN rules. I understand the drive to make payment as easy as ABC but then also put yourself in the bad guys’ shoes. I can only but wonder how much damage this has caused your business now but you can still nip the bud. “The best time to plant a tree is 20 years ago. The second-best time is now” so, stop it now!

I hope you see the reason why commercial banks do thorough KYC and due diligence. You are already giving fraudsters a field day. I am not in the habit of writing long epistle, but I am sure a word is enough for the wise. “Do normal”! We moveeeee…

I got the opportunity to speak with the VPay managerial cadre sometime last month. As true, direct, and blunt as my previous post was (you can read the post here - https://lnkd.in/gmH7XfbY), it is heartwarming to know that they welcomed my feedback about their business calmly and most interestingly that they are on top of their game.

I am particularly impressed with the way their head of technology analyzed their architecture and internal process to me. A lot of my earlier concerns were already being worked on while some have been worked on and I am very happy to know that.

To the Software developers at VPay and the general VPay team, I say kudos!